The Best Personal Finance and Budgeting Apps for 2025

There are hundreds of Personal Finance Apps, choose the one that works the best for you!

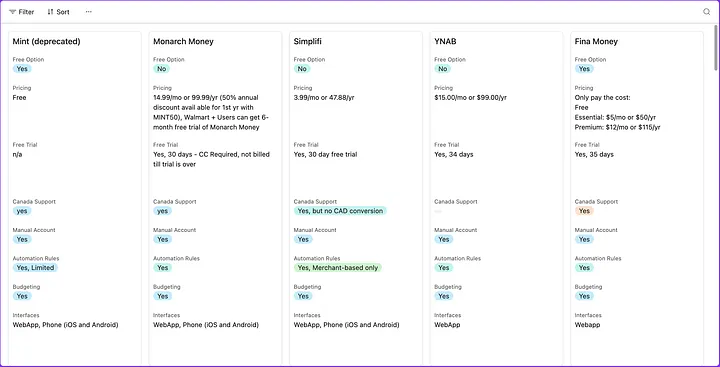

Check out Top Personal Finance Apps for a quick comparison.

Personal finance and budgeting apps have become essential tools for managing our finances in today's digital age, but this market is so crowded that it is hard to choose the best one for you.

Companies are competing to provide the best features, user experience, and integrations with banks and financial institutions. When you search for the best personal finance apps, you will find a lot of articles and reviews, but they are often biased or outdated. In this article, we will explore the key features that make a personal finance app the best choice for you, and why Fina is the best personal finance and budgeting app in 2025.

Key Features of the Best Personal Finance Apps

When it comes to personal finance apps, there are several key features that set the best ones apart from the rest:

- Automatic Bank Syncing: The best personal finance apps can automatically sync with your bank accounts, credit cards, and investment accounts to provide real-time updates on your financial status. This eliminates the need for manual data entry and ensures that your financial data is always up-to-date.

- Budgeting Tools: The best personal finance apps offer robust budgeting tools that allow you to set financial goals, track your spending, and create budgets based on your income and expenses. This helps you stay on top of your finances and make informed decisions about your money.

- Expense Tracking: The best personal finance apps provide detailed expense tracking features that categorize your spending, identify trends, and help you understand where your money is going. This allows you to make adjustments to your budget and spending habits as needed.

- Investment Tracking: The best personal finance apps offer investment tracking features that allow you to monitor your investment portfolio, track performance, and make informed investment decisions. This is especially important for those who want to grow their wealth over time.

- User-Friendly Interface: The best personal finance apps have a user-friendly interface that makes it easy to navigate and access your financial information. This is important for ensuring that you can quickly find the information you need and make informed decisions about your finances.

- Security Features: The best personal finance apps prioritize security and offer features such as two-factor authentication, encryption, and secure data storage to protect your financial information from unauthorized access.

- Customizable Reports: The best personal finance apps allow you to generate customizable reports that provide insights into your financial health, spending habits, and investment performance. This helps you make informed decisions about your finances and track your progress over time.

- Mobile Accessibility: The best personal finance apps are accessible on mobile devices, allowing you to manage your finances on the go. This is important for those who want to stay on top of their finances while traveling or away from their computers.

- Integration with Other Financial Tools: The best personal finance apps integrate with other financial tools and services, such as tax software, bill payment services, and financial planning tools. This allows you to manage all aspects of your finances in one place.

- Customer Support: The best personal finance apps offer reliable customer support to help you with any issues or questions you may have. This is important for ensuring that you can get the help you need when you need it.

Why Fina is the Best Personal Finance App in 2025

Fina is a personal finance app that stands out from the competition in several ways:

- Automatic Bank Syncing: Fina supports automatic bank syncing with over 20,000 banks and financial institutions worldwide, ensuring that your financial data is always up-to-date.

- Robust Budgeting Tools: Fina offers powerful budgeting tools that allow you to set financial goals, track your spending, and create budgets based on your income and expenses. You can easily categorize your transactions and monitor your progress towards your financial goals.

- Detailed Expense Tracking: Fina provides detailed expense tracking features that categorize your spending, identify trends, and help you understand where your money is going. You can easily view your spending by category, merchant, or time period.

- Investment Tracking: Fina offers investment tracking features that allow you to monitor your investment portfolio, track performance, and make informed investment decisions. You can easily view your investment holdings, performance, and asset allocation.

- User-Friendly Interface: Fina has a clean and intuitive user interface that makes it easy to navigate and access your financial information. You can quickly find the information you need and make informed decisions about your finances.

- Security Features: Fina prioritizes security and offers features such as two-factor authentication, encryption, and secure data storage to protect your financial information from unauthorized access.

- Customizable Reports: Fina allows you to generate customizable reports that provide insights into your financial health, spending habits, and investment performance. You can easily create reports based on your specific needs and preferences.

- Mobile Accessibility: Fina is accessible on mobile devices, allowing you to manage your finances on the go. You can easily view your financial information, track your spending, and make informed decisions from anywhere.

- Integration with Other Financial Tools: Fina integrates with other financial tools and services, such as tax software, bill payment services, and financial planning tools. This allows you to manage all aspects of your finances in one place.

- Reliable Customer Support: Fina offers reliable customer support to help you with any issues or questions you may have. You can easily reach out to their support team via email or chat for assistance.

- AI-Powered Insights: Fina uses AI to provide personalized financial insights and recommendations based on your spending habits and financial goals. This helps you make informed decisions about your finances and achieve your financial objectives.

- Community and Resources: Fina has a vibrant community of users and provides educational resources to help you improve your financial literacy and make informed financial decisions.

Fina is not just another personal finance app; it is a comprehensive financial management platform that empowers you to take control of your finances and achieve your financial goals.

Fina is also the most secure personal finance app in 2025, with a strong commitment to protecting your financial information. It uses bank-level encryption to ensure that your data is safe and secure, and it offers two-factor authentication to protect your account from unauthorized access.

With Fina, you can easily build a modern finance tracking system for free, whether you are a beginner or an experienced user. Its powerful features, user-friendly interface, and commitment to security make it the best personal finance app in 2025.

Conclusion

In conclusion, the best personal finance and budgeting apps offer a range of features that help you manage your finances effectively. Fina stands out as the best choice in 2025 due to its automatic bank syncing, robust budgeting tools, detailed expense tracking, investment tracking, user-friendly interface, security features, customizable reports, mobile accessibility, integration with other financial tools, reliable customer support, AI-powered insights, and vibrant community.

If you're looking for a personal finance app that can help you take control of your finances and achieve your financial goals, Fina is the best choice for you. With its powerful features and user-friendly interface, Fina makes it easy to manage your finances and make informed decisions about your money.

Again, feel free to check out Top Personal Finance Apps for a quick comparison, and see how Fina compares to other personal finance apps in the market. Hopefully, you will eventually choose Fina as your personal finance app of choice.