What Fina Can Do That Other Personal Finance Apps Can’t

Would you like to choose an app that adapts to you, or vice versa?

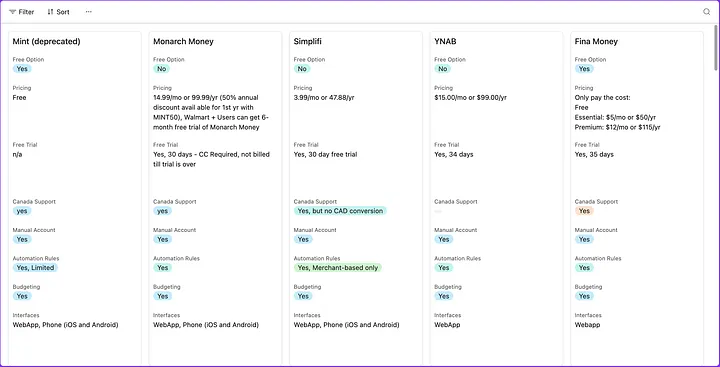

In a crowded personal finance app landscape, choosing the right tool can make the difference between tolerating your finances and truly mastering them.

While apps like Monarch Money have made strong strides in budgeting and mobile experience, Fina Money is emerging as a fundamentally different platform - one built for giving you true ownership, flexibility, and control over how you view, organize, and grow your financial life.